Before you withdraw your Required Minimum Distribution (RMD) this year from your IRA, be aware that if you are age 70½ or older, you can make direct charitable gifts from a qualified individual retirement account, including required minimum distributions, of up to $100,000 to Save Mount Diablo.

When an IRA distribution is transferred directly to a charity, that income is not reported as taxable income on one’s federal income tax return. Though such a gift is not eligible for a charitable deduction, not paying tax on otherwise taxable income is the equivalent of a charitable deduction. (See more details here.)

Please consult your financial advisor before making charitable gift decisions involving IRA transfers.

Scenario below!

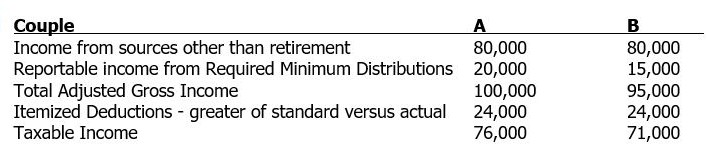

Two taxpayer couples, A and B , who have similar taxable income and potential itemized deductions, are considering making year end charitable contributions.

Each couple has taxable income from sources other than retirement of $80,000. In addition, each couple will be required to take $20,000 in Required Minimum Distributions from their IRA’s, adding to their taxable income.

Each couple has potential itemized deductions from Medical, Taxes and Interest of $16,000.

Couple A takes their Required Minimum Distributions as regular distributions and deposits the net proceeds in their checking account. They then issue checks totaling $5,000 to charitable organizations. This brings their potential Itemized deductions to $21,000.

Couple B instructs their IRA Trustee to issue checks totaling $5,000 directly to the charitable organizations they designate. These direct distributions, known as Qualified Charitable Distributions (QCD), count toward their Required Minimum Distribution. They then take the $15,000 remaining minimum distribution as regular distributions and deposit the net proceeds in their checking account. Their potential itemized deductions stay at $16,000 because Qualified Charitable Distributions cannot be deducted on their tax return.

The result of the differing methods of funding the same amount of charitable contributions by couples A and B are illustrated below. Two key issues result in different taxable income for the couples: One, normal Required Minimum Distributions from standard IRA’s are considered ordinary income on the tax return. Two, Qualified Charitable Distributions are excluded from income on the tax return.

Additionally, the increase of the “married filing jointly—standard deduction” to $24,000 for 2018 may negate potential benefits of charitable contributions made by cash, personal checks and fair market donations.

Even though both couples had the same amount of income and deductions, Couple B’s use of Qualified Charitable Distributions reduced their taxable income by $5,000.